InnoCare has initiated the global phase 3 trial of orelabrutinib plus bendamustine and rituximab in patients with 1L MCL.

Seeking opportunities in the United States

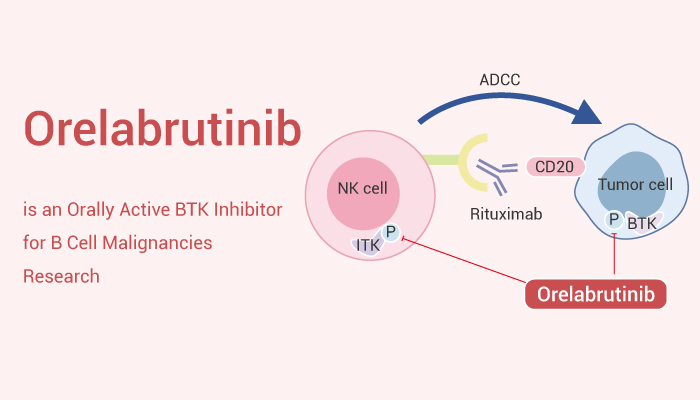

In 2020, the China NMPA authorized the first market approval of Orelabrutinib for rrMCL and rrSSL/CLL. Then, in 2023, Orlabrutinib became the first BTK inhibitor for rrMZL in China. As announced at the 2024 J.P. Morgan Healthcare Conference, more than 30,000 patients have received Orelabrutinib, leading to an increase in annual sales to approximately 671 million RMB (equivalent to 93 million USD) at a rate of 18.5%.

|

| Orelabrutinib |

The United States is a dream destination for Chinese domestic biopharma, including InnoCare. According to InnoCare's presentation, they plan to submit an NDA seeking approval for rrMCL in the US in Q3 2024. However, the FDA has become more strict in recent years regarding confirmatory trials for drugs that have conditional approvals. This action was taken because the promised trials were not carried out promptly or when conducted, failed to confirm the efficacy or safety of the drugs. For InnoCare to get their NDA accepted by the FDA, they must ensure that the randomized confirmatory trial is well underway, and ideally, fully enrolled.

BTK inhibitors in the frontline for MCL

The regulatory bodies in China and the US have approved five different BTK inhibitors for various indications. Beigene is the first Chinese pharmaceutical company to introduce innovative drugs to the US market, boasting a global revenue of 1.29 billion USD (946 million in the US, 194 million USD in China). So which company would refuse such a generous offer?

|

Product |

Company |

Stage |

Indication in China |

Indication in the US |

|

Ibrutinib |

Janssen |

Marketed |

rrCLL/SLL rrMCL |

CLL/SLL WM cGVHD |

|

Zanubrutinib |

Beigene |

Marketed |

rrCLL/SLL rrMCL WM |

rrCLL/SLL rrMCL WM rrMZL rrFL |

|

Orelabrutinib |

Innocare |

Marketed |

rrCLL/SLL rrMCL rrMZL |

- |

|

Acalabrutinib |

AstraZeneca |

Marketed |

rrCLL/SLL rrMCL |

rrMCL CLL/SLL |

|

Pirtobrutinib |

Lilly |

Marketed |

- |

rrMCL rrCLL/SLL |

Orange: Discovered by a China-based company. Arranged according to the approval date in China.

The lack of improvement in the 7-year overall survival rate during the phase 3 trial of ibrutinib+BR, despite a significant extension of progression-free survival, is surprising. Overall survival was similar in the two groups (hazard ratio for death, 1.07; 95% CI, 0.81 to 1.40). Overall survival at 7 years was 55.0% in the ibrutinib group and 56.8% in the placebo group. The median progression-free survival as assessed by the investigators was 80.6 months (95% confidence interval [CI], 61.9 to not evaluable) in the ibrutinib group, as compared with 52.9 months (95% CI, 43.7 to 71.0) in the placebo group (stratified hazard ratio for disease progression or death, 0.75; 95% CI, 0.59 to 0.96; P=0.01)

So JNJ and AbbVie made the decision to withdraw the accelerated approval in the United States.

|

Product |

Combo |

Indication |

Status |

Initiated |

Enrollment |

|

Ibrutinib |

BR |

1L MCL |

Failed |

2013.01.28 |

523 |

|

Zanubrutinib |

BR |

1L MCL |

Ongoing |

2019.08.21 |

510 |

|

Orelabrutinib |

BR |

1L MCL |

Ongoing |

2024.05.25 |

490 |

|

Acalabrutinib |

BR |

1L MCL |

Ongoing |

2017.04.05 |

635 |

|

Pirtobrutinib |

- |

2L MCL |

Ongoing |

2021.04.08 |

500 |

BR: bendamustine plus rituximab

Yuqin Song et al. compared the efficacy of zanubrutinib and orelabrutinib in relapsed or refractory mantle cell lymphoma patients indirectly. The naïve comparison showed that ORR assessed by the investigator was similar between zanubrutinib and orelabrutinib (83.7% vs. 87.9%; risk difference, -4.2 [95% CI: -14.8%, 6.0%]). CR rate was significantly higher in zanubrutinib compared with orelabrutinib (77.9% vs. 42.9%; risk difference, 35.0% [95% CI: 14.5%, 53.7%]

Beigene launched zanubrutinib in the US in November 2019, and in China in June 2020. Innocare, on the other hand, marketed orelabrutinib only six months later in China. However, InnoCare failed to meet the development timeline required for Orelabrutinib to become a global blockbuster, resulting in less than 10% of global zanubrutinib sales. Can InnoCare now do something to recover their losses?

Comments